Mortgage and Real Estate Market Predictions for 2026

What Buyers and Homeowners Need to Know

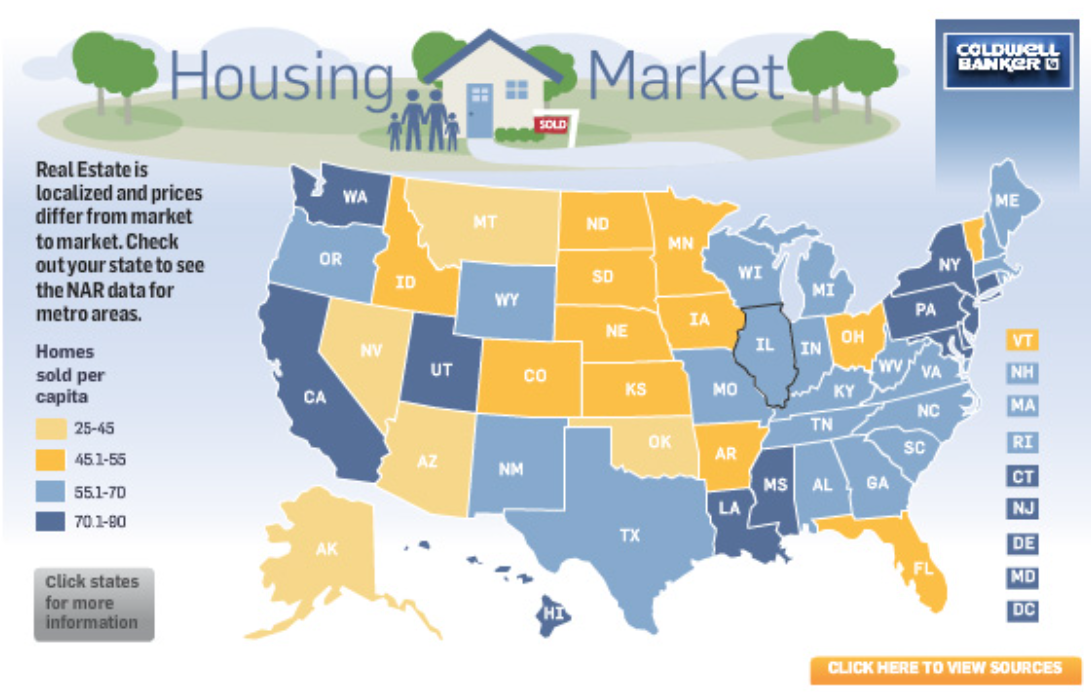

The housing market is entering a period of steadier conditions after several years of dramatic ups and downs. Mortgage rates have eased slightly from their peak and buyers are seeing a bit more breathing room. Prices continue to rise but at a more predictable pace and inventory is slowly improving in many regions.

This guide covers

• National Picture in 2026

• California Trends for 2026

• Local Markets | Bay Area 2026

• 2026 Mortgage Rates

• Key Takeaways

• 2026 for First Time Buyers

The goal is to help you make confident decisions in 2026 based on real data and current indicators.

The National Housing Picture in 2026

Current Conditions

Data through late 2025 shows:

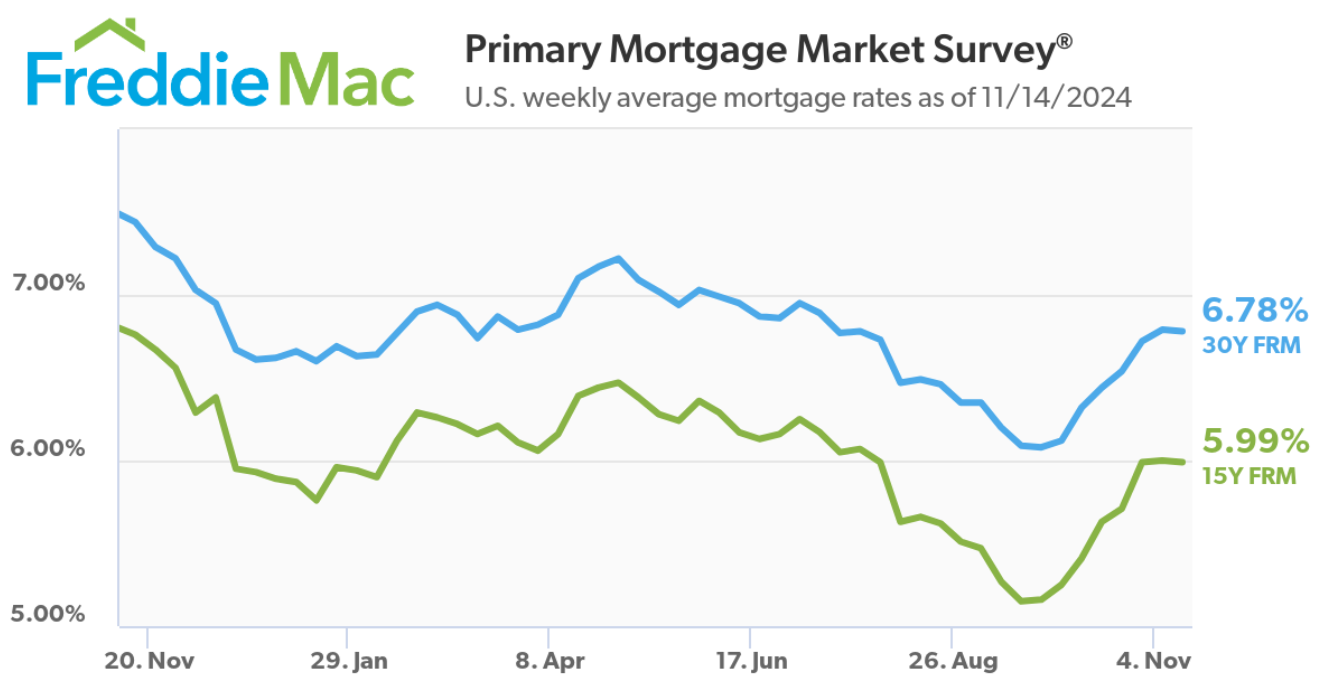

Thirty year fixed mortgage rates are hovering just above six percent according to Freddie Mac surveys and recent reporting

National home values are expected to rise slightly more than one percent over the next twelve months based on current Zillow forecasts

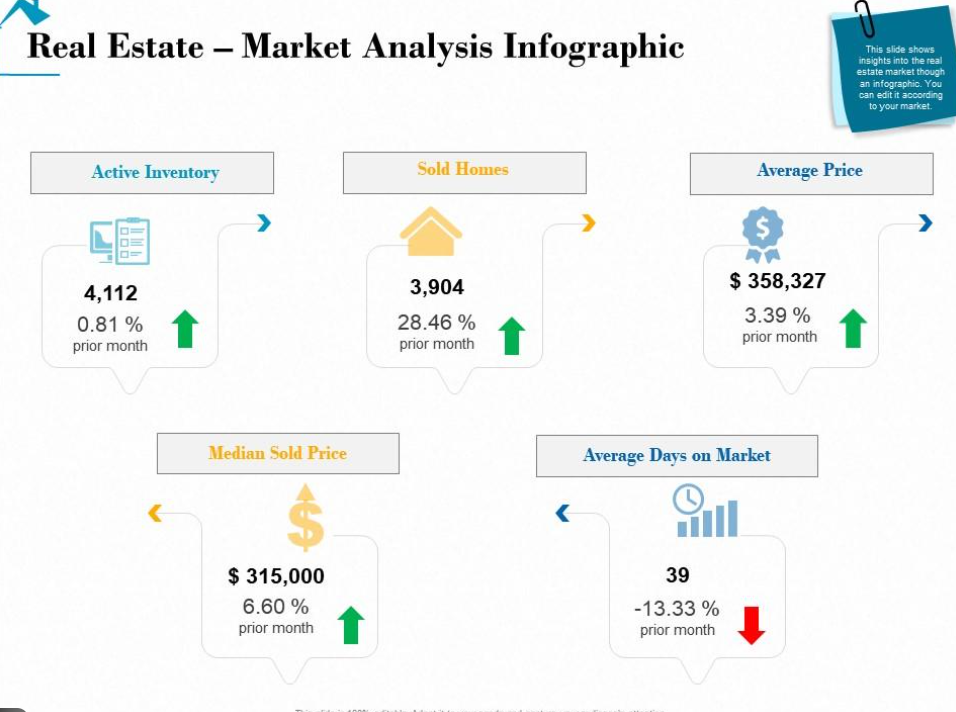

Existing home sales have remained near four million per year which is below the long term average of about five million

Affordability remains a challenge but buyers are beginning to see more inventory and more realistic pricing.

Sales Volume Forecast

Economists expect meaningful improvement in 2026

National Association of Realtors models project existing home sales to climb about fourteen percent

New construction sales are expected to increase about five percent

This rebound is driven by lower inflation, slightly easier mortgage rates, and more homeowners choosing to list their properties after waiting out market uncertainty.

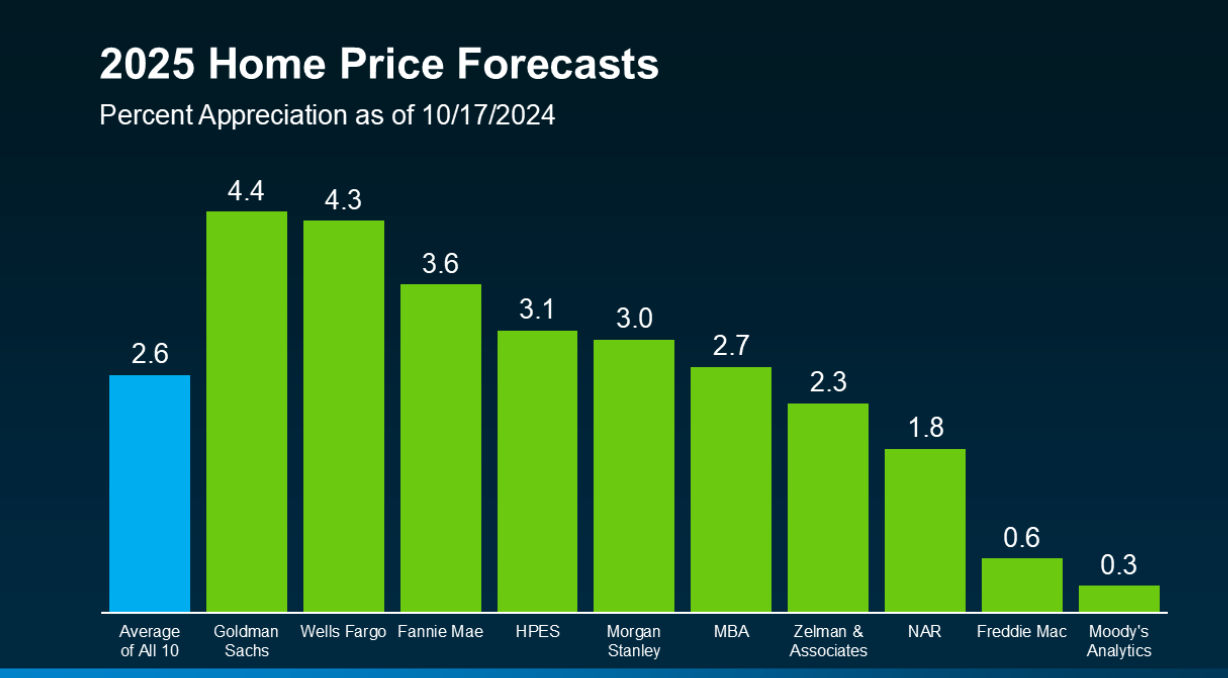

Home Price Expectations

There is broad agreement on one theme: moderate growth.

Fannie Mae forecasts national price growth of approximately one percent in 2026

NAR projects closer to four percent growth nationally

Zillow projects a slow upward trend that gains momentum into 2026

The key message is stability. Not a crash and not rapid appreciation but healthy and sustainable movement.

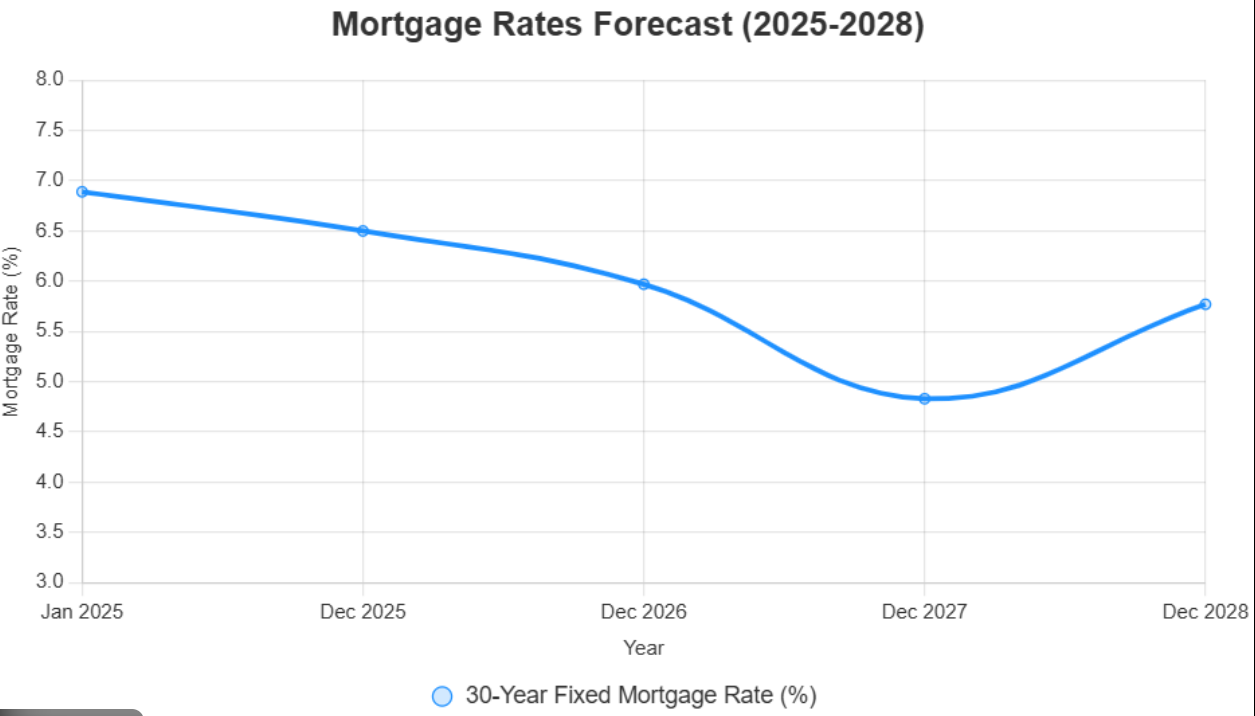

Mortgage Rate Outlook for 2026

Several major forecasting agencies expect thirty year fixed mortgage rates to settle into the low six percent range

The Mortgage Bankers Association expects an average rate near six point four percent by the end of 2026

Fannie Mae projects rates closer to six point one percent

Analysts agree that rates are unlikely to return to the very low levels seen during the pandemic

The most realistic expectation is a narrow rate band between six percent and six point five percent, with occasional dips but no major long term drops.

National Takeaways for 2026

More homes available

More closed transactions

Gradual price growth

Mortgage rates that remain manageable but still elevated compared to historic lows

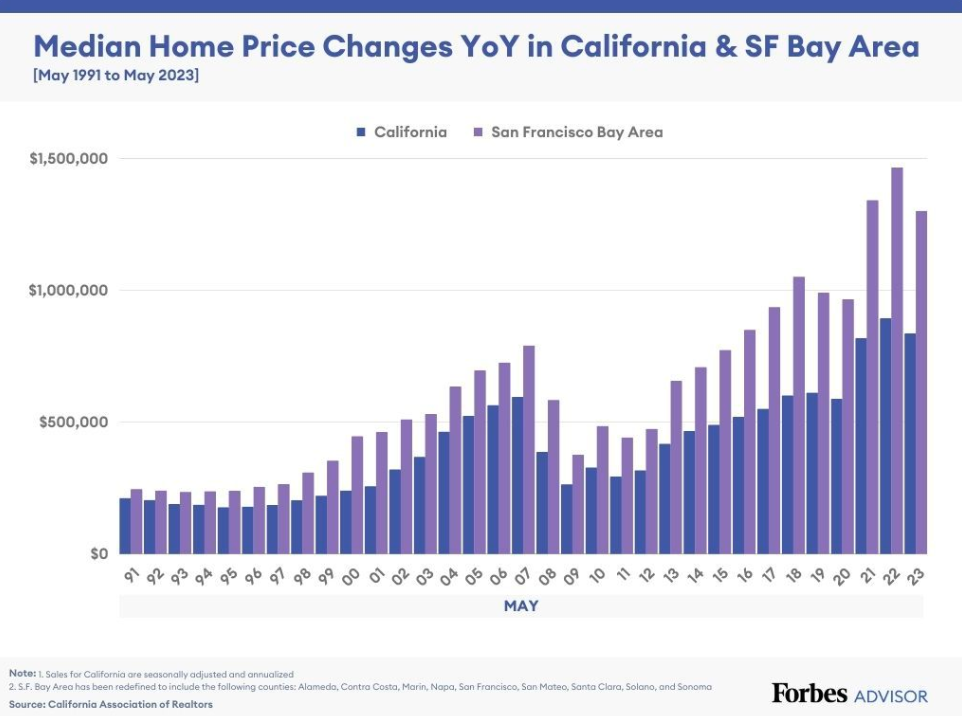

What This Means for California Real Estate

California continues to follow its own rhythm with higher prices, more varied regional trends, and persistent inventory constraints. Forecasts for 2026 include

Home sales rising about two percent to roughly two hundred seventy four thousand closed transactions

A projected state median home price near nine hundred five thousand dollars which represents growth of about three point six percent

Improved affordability with an estimated eighteen percent of households able to purchase the median priced home

The picture is still expensive but there is gentle improvement in buyer opportunity.

Regional Focus

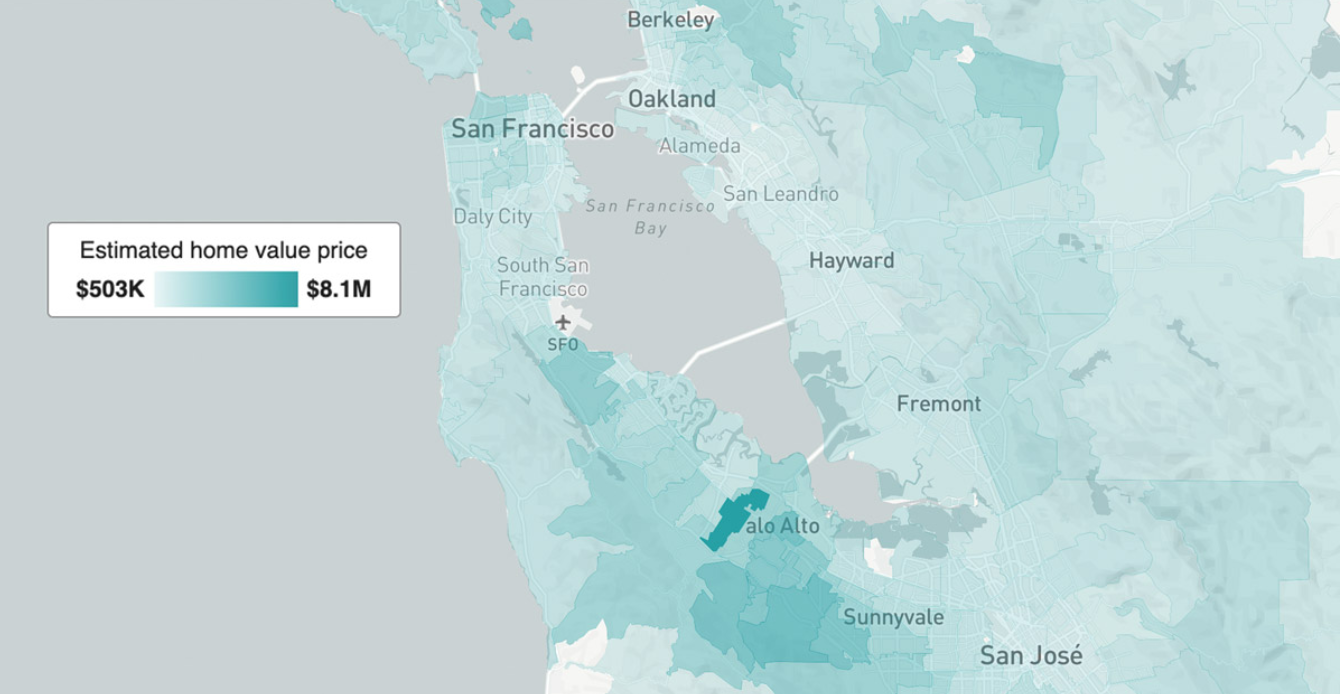

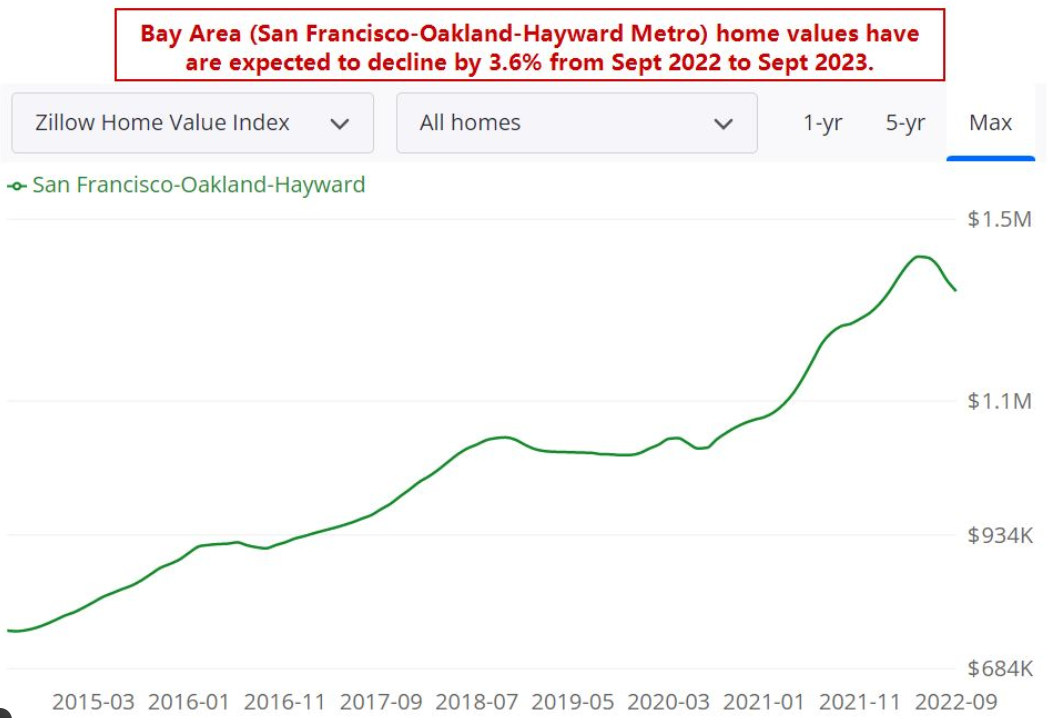

The Bay Area and Local Markets

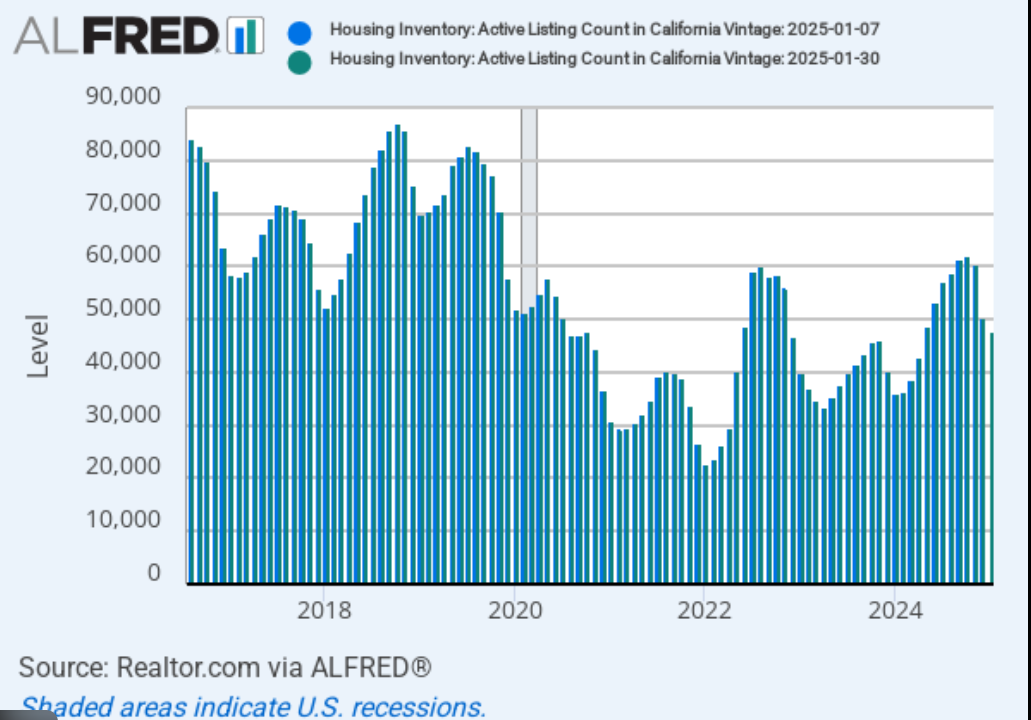

Local conditions are mixed and highly neighborhood dependent. Analysts expect

A mild price decline of roughly three percent between mid 2025 and mid 2026 in parts of the Bay Area

Increased strength in some urban cores including parts of San Francisco supported by renewed hiring in technology and artificial intelligence sectors

More balanced inventory with fewer bidding wars compared to the aggressive pace of earlier years

For buyers this means more choices, more realistic pricing, and the possibility of negotiating seller credits or rate buydowns.

Special Section for First Time Buyers in California

Buying your first home in California in 2026 will require clear planning. Here is what to expect

Prices remain high but appreciation is slowing

Mortgage rates will hover in the low six percent range which helps with predictability

Inventory is improving which means less competition and more negotiating power

Creative financing and strategic offer planning will matter more than ever

We created a dedicated resource to support first time buyers.

Read our First Time Buyer Guide:

[First Time Buyer Article Link Goes Here]

How to Use These Forecasts to Build Your 2026 Plan

If You Plan to Buy

Build your budget around a six percent mortgage rate

Compare neighborhoods because statewide averages hide softer markets nearby

Focus on total cost including taxes, insurance, and any association dues

Explore seller credits for closing costs or rate buydowns which are becoming more common

If You Already Own a Home

A refinance may make sense even if your rate is lower if you want to consolidate debt or change your loan term

Expect steady but slower appreciation which gives you time to strategize your next move

For investors, 2026 may offer more balanced pricing and less competition in targeted markets

A One Sentence Summary

Barring major economic surprises, 2026 is shaping up to be a year of steady improvement in both mortgage affordability and home availability with gradual price growth and more predictable buying conditions.

Ready to Build Your 2026 Strategy

Every situation is unique and forecasting is only the first step. The most valuable next step is a personal strategy session where we can map out

• Your price range

• Your timeline

• Your financing options

• Your most advantageous path in the 2026 landscape

Click here to book your one on one consultation and start planning your 2026 goals.